A self-directed IRA is undoubtedly an unbelievably powerful investment auto, but it really’s not for everybody. As being the declaring goes: with terrific electrical power will come good obligation; and using an SDIRA, that couldn’t be more real. Keep reading to understand why an SDIRA may possibly, or may not, be for yourself.

Bigger Fees: SDIRAs often feature greater administrative expenses when compared with other IRAs, as selected aspects of the administrative process can not be automatic.

An SDIRA custodian is different since they have the right employees, knowledge, and capability to take care of custody of your alternative investments. The initial step in opening a self-directed IRA is to locate a supplier that is specialized in administering accounts for alternative investments.

Choice of Investment Solutions: Make sure the service provider lets the kinds of alternative investments you’re keen on, which include real estate property, precious metals, or private equity.

Producing essentially the most of tax-advantaged accounts helps you to preserve more of The cash which you make investments and earn. Depending on regardless of whether you choose a standard self-directed IRA or a self-directed Roth IRA, you have the prospective for tax-no cost or tax-deferred progress, provided specified problems are fulfilled.

Higher investment selections usually means you'll be able to diversify your portfolio past shares, bonds, and mutual funds and hedge your portfolio versus current market fluctuations and volatility.

Consider your Close friend might be setting up the next Facebook or Uber? By having an SDIRA, you can spend money on brings about that you suspect in; and potentially get pleasure from higher returns.

Opening an SDIRA can provide you with use of investments Usually unavailable through a bank or brokerage firm. Right here’s how to begin:

Put merely, in case you’re searching for a tax productive way to construct a portfolio that’s much more tailored to your interests and skills, an SDIRA may be The solution.

In advance of opening an SDIRA, it’s imperative that you weigh the likely advantages and drawbacks depending on your specific money objectives and possibility tolerance.

Entrust can guide you in buying Check Out Your URL alternative investments with all your retirement funds, and administer the shopping for and advertising of assets that are typically unavailable by banks and brokerage firms.

Transferring resources from just one variety of account to a different kind of account, for example going funds from the 401(k) to a traditional IRA.

The tax rewards are what make SDIRAs desirable for many. An SDIRA can be equally classic or Roth - the account type you decide on will rely mostly with your investment and tax method. Check out using your fiscal advisor or tax advisor for those who’re Doubtful which happens to be ideal for you personally.

Ease of Use and Technologies: A consumer-pleasant System with on the net tools to track your investments, post documents, and deal with your account is essential.

Have the freedom to speculate in Practically any kind of asset with a possibility profile that matches your investment tactic; such as assets which have the possible for the next charge of return.

The key SDIRA guidelines with the IRS that traders will need to understand are investment restrictions, disqualified individuals, and you can check here prohibited transactions. Account holders have to abide by SDIRA policies and restrictions so that you can protect the tax-advantaged standing of their account.

SDIRAs in many cases are used by palms-on traders who're willing to take on the pitfalls and tasks of choosing and vetting their investments. Self directed IRA accounts can even be perfect for traders who've specialized understanding in a niche marketplace which they would like to spend money on.

Complexity and Responsibility: Using an SDIRA, you have got extra Regulate above your investments, but Additionally you bear much more obligation.

Purchaser Support: Seek out a company that offers committed help, together with entry to professional specialists who will response questions on compliance and IRS guidelines.

Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Mason Reese Then & Now!

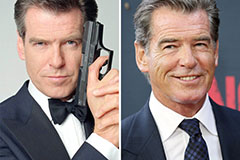

Mason Reese Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!